MT4 Chart with Premium Scanners

We are one place service provider for a trader who trade in Indian or International Financial Market. We provide Best Indicators and Scanners with High accuracy Data in the Market. We also provide free Indicators and templates.

Services start from ₹400 / Month

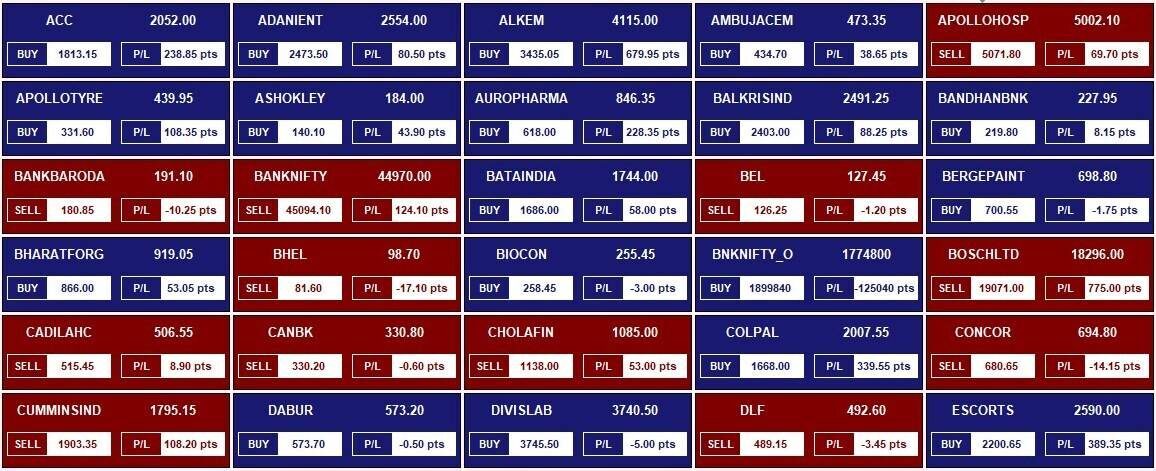

Our Services

Everything Related To Stock Market Education Under One Roof

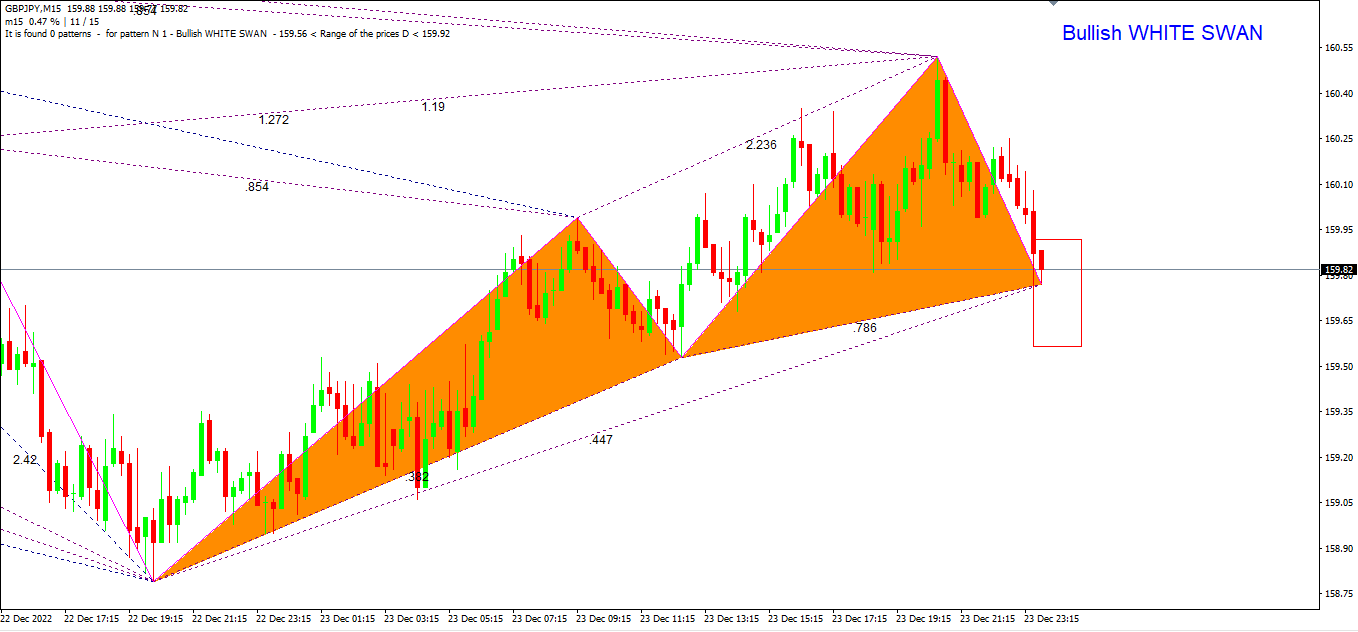

Meta Trader 4

Get All Segments Real-Time MT4 Data Feed at 400/m. MT4 is Technical Based Charting Software. Provide Buy Sell Alert with Targets and SL.

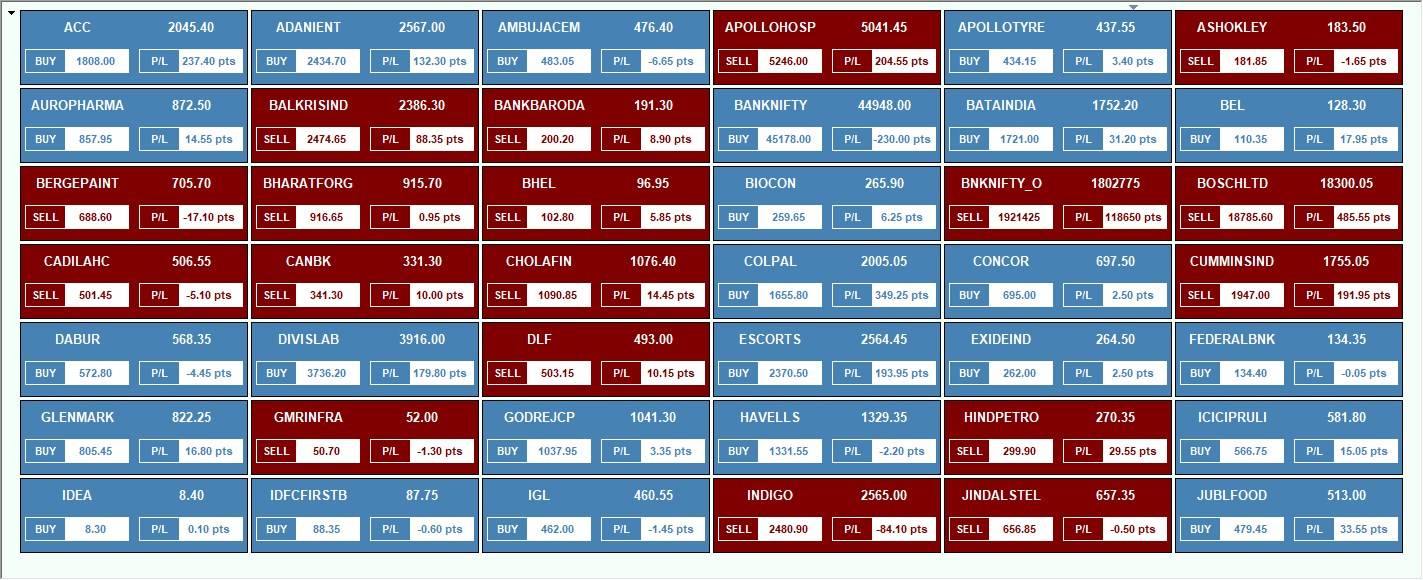

Ami Broker

Real Time #1 Data Feeder for Amibroker. Extremely accurate streaming Data and Charts. Compare with your Trading Terminal any time.